Ever since Moneyball, I’ve paid attention to what Michael Lewis writes about and have been looking forward to his new book, The Big Short: Inside the Doomsday Machine, about the subprime collapse and subsequent financial crisis. At long last, it was my weekend read and proved to be worth the wait.

Ever since Moneyball, I’ve paid attention to what Michael Lewis writes about and have been looking forward to his new book, The Big Short: Inside the Doomsday Machine, about the subprime collapse and subsequent financial crisis. At long last, it was my weekend read and proved to be worth the wait.

In typical fashion, it’s well paced with great depictions of interesting people who see the world a little differently. He explains everything about as clearly as you can (when describing financial instruments intentionally named and designed to be difficult to understand), and undoubtedly oversimplifies some concepts and omits details of other (such as Paulson’s gigantic short). Overall, however, the narrative is engaging and insightful and seems to a layman such as myself to be fairly balanced.

As with Moneyball, I find myself wanting to know more about (if not meet!) some of the central figures who in this case brilliantly shorted the market. Colorful people like Michael Burry and Steve Eisman who rejected conventional wisdom and profited wildly.

He provides a suitable indictment of those who should have prevented the disaster, summed up like this (emphasis mine):

The people in a position to resolve the financial crisis were, of course, the very same people who had failed to foresee it: Treasury Secretary Henry Paulson, future Treasury Secretary Timothy Geithner, Fed Chairman Ben Bernanke, Goldman Sachs CEO Lloyd Blankefein, Morgan Stanley CEO John Mack, Citigroup CEO Vikram Pandit, and so on… With them were a handful of government officials… All shared a distinction: They had proven far less capable of grasping basic truths in the heart of the U.S. financial system than a one-eyed money manager with Asperger’s syndrome.

It’s of course the tangents like Mike Burry’s Asperger’s condition that are some of the best elements of Lewis’ writing. People who see the world differently, and in this case, put their money where they mouth is.

Lewis, Michael. The Big Short: Inside the Doomsday Machine.

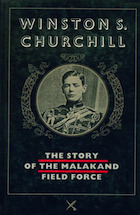

The story of a young Winston Churchill in 1897 fighting fanatical tribal warriors in modern day Pakistan–see his chilling description of what we hear all too often in today’s news:

The story of a young Winston Churchill in 1897 fighting fanatical tribal warriors in modern day Pakistan–see his chilling description of what we hear all too often in today’s news: